It enables a taxpayer to claim a tax credit of up to $2,000 per family for the cost of qualified tuition and related expenses paid by the taxpayer during the tax year on behalf of the taxpayer, the taxpayer’s spouse, or the taxpayer’s dependents. The Lifetime Learning tax credit is applicable to any level of post-secondary education. Your allowable lifetime learning credit may be limited by the amount of your income and the amount of your tax. This means that it can reduce your tax to zero, but if the credit is more than your tax, the excess won’t be refunded to you. The lifetime learning credit is a nonrefundable credit. Unlike a deduction, which reduces the amount of income subject to tax, a credit directly reduces the tax itself. A tax credit reduces the amount of income tax you may have to pay.

There is no limit on the number of years the lifetime learning credit can be claimed for each student.

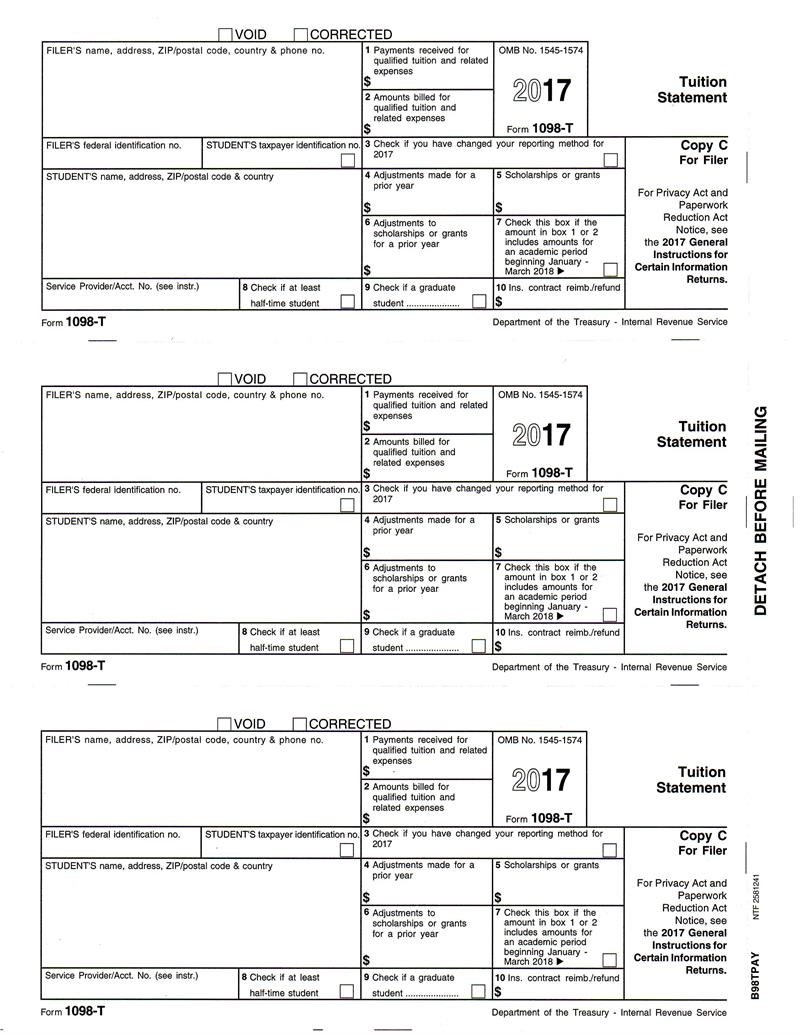

Lifetime learning creditįor the tax year, you may be able to claim a lifetime learning credit of up to $2,000 for qualified education expenses paid for all eligible students. However, continuing education students may be eligible for the lifetime learning tax credit. As a result, we do not provide 1098-T forms.

1098 t qualified education expenses professional#

Our Professional Development and Bootcamp continuing studies courses are non-credit programs. Please consult your tax advisor or IRS Publication 970 to see if you can claim tuition and related expenses not reported on your IRS Form 1098-T. It does not allow us to report non-credit courses. The IRS considers this to be classes where credit was earned. The IRS requires educational institutions to report amounts paid for qualified tuition related expenses only.

0 kommentar(er)

0 kommentar(er)